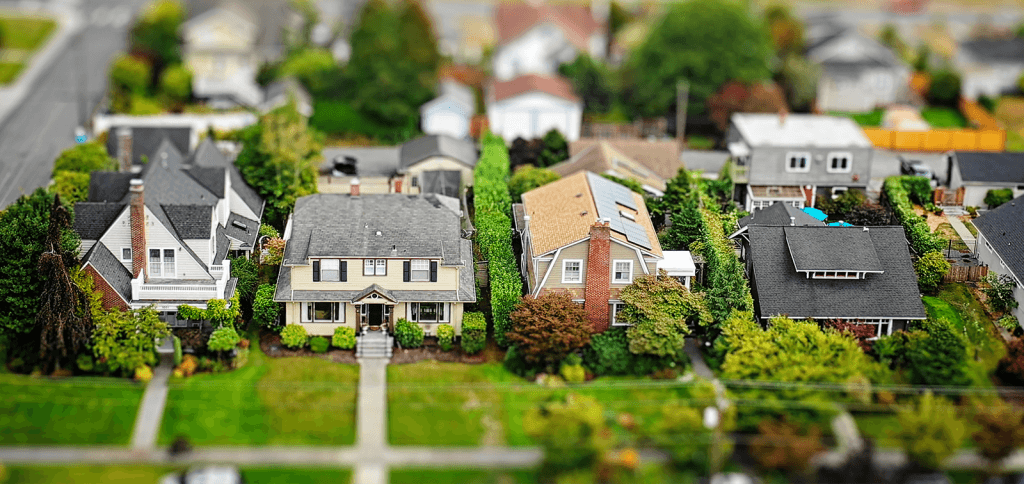

More Existing Homes May Hit the Market as Owners Prepare to Sell

After sitting at a record low for months, existing home inventory will likely get a boost thanks to many homeowners’ newfound comfort with selling. Seller attitudes are aligned with the general public, as 61% of Americans recently said it was a good time to sell a home. The shift in attitude may have been driven by the …

More Existing Homes May Hit the Market as Owners Prepare to Sell Read More »