Be Prepared. Don’t Gamble Your House.

With the likelihood of rates dropping, preparation and advance planning is key. We’ve collected some key strategies and advice that might apply to your circumstances.

With the likelihood of rates dropping, preparation and advance planning is key. We’ve collected some key strategies and advice that might apply to your circumstances.

Our hearts go out to everyone impacted by the devastating wildfires in Los Angeles. Beyond the immediate trauma and loss, these events bring critical questions

The housing market’s complexity requires various regulations to ensure both borrower protection and lender stability. One such regulation, crucial for maintaining the balance, is the

Buying a home can be complicated, especially when understanding the different types of mortgages. Qualified mortgages (QMs) are loans that follow specific rules to make

When it comes to securing a mortgage, not everyone fits the mold required for a traditional, qualified mortgage (QM). Nonqualified mortgages (non-QM) can provide a

Buying a home is more than just a transaction; it’s a significant milestone in your life. As your trusted partner in homeownership, we’re committed to

Deciding whether to buy a home now or wait involves carefully considering various factors. Here’s a breakdown to help you make an informed decision. When

Knowing about the latest industry guidelines and shifts can significantly impact your investment strategies in the ever-evolving realm of real estate and financing. Fannie Mae,

The California Housing Finance Agency (CalHFA) is gearing up for Phase 2 of its very exciting Down Payment Assistance (DPA) program called the Dream for

Move-up home buyers are in a commanding situation. Tight inventory has left them in a great position to sell their current home. Despite concerns that

If you just closed on your new home, you’ve probably got a lot of things on your mind, like home maintenance, homeowners insurance, and property

Are you looking to set yourself up financially? Purchasing a home is one of the biggest investments most people make in their lifetime, and it’s

What is it? The California Dream for All Down Payment Assistance Program is a state-funded program designed to help prospective homebuyers with low to moderate

Are you considering taking advantage of a temporary rate buydown to get a lower interest rate on your home loan? Be aware that this strategy

Buying a home is a big decision and can often be daunting, especially for first-time homebuyers. One of the biggest challenges facing first-time buyers is

On February 16th, 2021, the Department of Veterans Affairs (VA) announced a change to the funding fee charged on VA loans. The funding fee is

FHA loans will become more desirable and affordable. The US Department of Housing and Urban Development (HUD) announced today that it would provide lower monthly

Are you considering relocating to a different area or another state? Lower cost of living, a better quality of life, or to be closer to

When purchasing a home, three main components determine your eligibility. They are income, down payment, and credit history. It gets complicated (especially for those outside

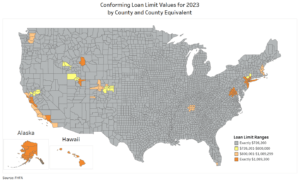

Like last year, the limits are increasing again. Conforming loan limits increased from last year’s $647,200 to $726,200 for 1-unit properties. In high-limit areas like

Mortgage lenders are bringing back a loan program called a 2-1 buydown or temporary buydown. These programs have been around for a while but only

Bringing homeownership to you in the State of Tennessee, QHL makes it simple by providing more ways to say yes! Learn more about Tennessee’s housing

Obtaining a home loan while self-employed has all the same steps and qualifying metrics as any other loan. We measure credit. We measure loan-to-value. We

Home equity is at an all-time high. Borrowing money secured against your home can be a great way to consolidate debt and get cash for

With the vast gains in home equity you’ve realized recently, you might ask yourself: “What is the best way to borrow money from my home?”

Bringing homeownership to you in the State of Idaho, QHL makes it simple by providing more ways to say yes! Learn more about Idaho’s housing

Since our launch in 2012, the team at QHL has methodically built the company to support our mission: making homeownership simple by providing smart loan options,

When you apply for most traditional mortgages, you’ll hand the lender a stack of documents to prove your financial health and show you can repay

Think of a reverse mortgage as a conventional mortgage where the roles are switched. In a conventional mortgage, a person takes out a loan in

Getting the right mortgage can make all the difference when buying a home. But with so many lenders and loan products available, finding the best

Program Benefits Rate is fixed for the first 10 years Loan amounts up to $2.0M Get cash out with a low rate Available for second

There are two types of mortgage refinance: rate-term refinance and cash-out refinance. No cash allows you to adjust just the terms of your home loan.

The 2021 housing market was a bit tough for some home shoppers. Low rates and increased flexibility from working remotely put many first-time homebuyers on

Home prices have surged over the last year and a half, but as rates go up and more listings hit the market, that rise is expected to slow

Something we often hear from clients is they waited longer to get pre-approved than they needed to when starting to shop for their first home.

Are you considering becoming a part of the Great Resignation? If so, you may have some important considerations that affect your ability to borrow money

Housing inventory plunged during the pandemic, but there’s been a recent uptick. Rising inventory, of course, gives home shoppers a little more breathing room. And

Like last year, the limits are increasing again. While the FHFA’s official announcement isn’t until November, we have many lenders allowing us to use higher loan limits

“If you’re self-employed, you are back in the driver’s seat. Planning ahead to use your 2021 taxes to qualify for the loan you want is

It’s no secret that one of the most critical factors in getting qualified for a mortgage loan is documentable income. Lenders, both large and small,

Getting ready to buy your dream home? Whether you’ve already started doing your research or aren’t quite sure where to begin, we’re here to help

Some benefits of investing in real estate include passive income, equity, monthly rents, and tax breaks. If you’re thinking about purchasing an investment property, here

Having a good credit score is essential to passing many of the financial milestones of life. One being securing a low interest rate on a

In light of the fact that rates are improving, the Federal Housing Finance Agency (FHFA) announced today that it is also eliminating the Adverse Market

So, you’re self-employed and want to get a mortgage. For traditional W2 employees, this process is pretty cut and dry. But for self-employed borrowers (contractors,

During the past four decades, American consumers could count on this constant: The rate of inflation remained below the average rate of a 30-year mortgage. In many

In recent years, a popular adjustable rate mortgage option has been a 7/6 ARM and has become more widely available. With a 7/6 ARM, you’ll

Unless you’re part of the 25% or so of homebuyers who elect to put in an all-cash offer, you’ll likely need a mortgage (and a

With increasingly low supply on the market, home prices around the country are rising at their fastest pace in 15 years. It then comes as no

For many people, buying a new home or refinancing is the most complex financial transaction they’ll ever make. With the amount of information and documentation

Before the exciting process of house hunting can get underway, prospective homebuyers must be pre-approved for a mortgage. Pre-approval provides a clear picture of what a

If you’re an active service member, veteran or surviving spouse, VA loans can offer many home financing advantages that can help you get a foothold

After sitting at a record low for months, existing home inventory will likely get a boost thanks to many homeowners’ newfound comfort with selling. Seller

If you own a home, you’ve probably heard or seen a lot of buzz around refinancing in recent months, and you’re not alone. Many homeowners

The pandemic is revving up the higher end of the market and nudging more sales over the $500,000 mark from California to the New York

Once you’ve decided you’re ready to proceed with your purchase and have met with your Loan Officer to review the process, YOU’RE READY TO GET

QHL’s founder, Mike Pacheco, is featured in Top Agent Magazine as a Top Lender in California. Mike places particular emphasis on expertise, making sure he

Homeownership is a dream for almost everyone, yet can sometimes feel impossibly far away. But for qualifying veterans and their families, VA loans can help jumpstart

Since about 2010-2012 the prices of most houses in California have not declined at all. The opposite has happened. Home prices have gone up, and

If you’ve been home shopping in a higher-cost housing market, then you may have been presented with an option for a jumbo loan—even if the

When it comes to money-saving strategies for homeowners, refinancing your home can be near the top of the list. Of course, each refinance comes with a unique

With the current housing market’s record-low inventory and all-time-high price tags, waiting for more favorable conditions would seem like the smart move for homebuyers. However, historical data and current

When it comes to getting a lender’s approval to buy or refinance a home, there are 3 key numbers that affect your ability to qualify for

Last Tuesday, the Federal Housing Finance Agency (FHFA) announced that conforming loan limits will increase from $510,400 to $548,250 in 2021 marking the fifth straight year of

If you’re a first-time refinancer, you might be unsure about what to expect in the process. At QHL, our top priority is to provide you

When coming up with your monthly budget, don’t forget about the income tax savings. Compared to renting, you may see a significant tax advantage. Owning

While becoming a homeowner comes with a lot of responsibility, there is also a lot of rewards. Here are some of the main reasons people choose

So the past few months you’ve shopped properties, submitted offers, and finally you get the call from your real estate agent: Your latest offer has

When you purchase a home, you’ll need to be prepared to manage not only the down payment, but closing costs as well. We’ll work to

Choosing a mortgage isn’t all that painful if you know the lingo. Once you’ve done some homework and nailed down a budget and down payment

Mike Pacheco was highlighted in Orange Coast Magazine as a Mortgage All-Star, 2020. Read about his mission when he began QHL 8 years ago. Knowledgeable.

With purchase applications up, housing demand is 25% above pre-pandemic levels. Take a look at the following article for some insights about why listings are moving quickly.