For as long as I can remember, FHA loans have played second fiddle to Conventional loans. Conventional loans offer lower mortgage insurance rates, mortgage insurance that gets removed, looser work history and documentation requirements, no funding fee, and less strict property conditions. Clients with solid credit (740+) got a better loan both in the short-term and long-term by selecting Conventional loans over FHA loans.

On the other hand, Conventional loans add risk pricing to the rate. If credit is less than 740, say 712, and the property is a condo, the pricing on a Conventional loan made it worse than FHA. FHA loans fill a niche for lower down payment and lower credit scores. That is what they are designed to do. The higher property standards are designed to protect a borrower with limited means from a property needing work.

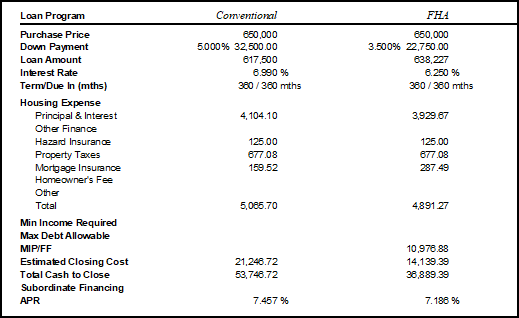

Recently, rates on conventional loans have been disproportionately affected by market volatility. With less than a 20% down payment, an FHA is a clear winner right now, even with a perfect credit score. Additionally, FHA recently lowered the MIP charged to borrowers, solidifying the benefits: payments are lower, down payment is lower, closing costs are lower, and it is more forgiving of risk factors like credit score and property type.

Here is a comparison of the monthly payments and estimated money due to close:

Choosing an FHA loan won’t solve all loan problems. Property condition is an essential factor, as well as your work history. FHA lenders are given more discretion to make underwriting judgment calls and are rated in the system for loans that go poorly. Choosing the right lender and/or working with an experienced broker will mitigate many problems before they exist.

Call us, and we’ll walk you through it!